Use your utility bill to increase your credit scores

Improve Your Credit Score with Utility Payment Reporting

7-day trial for $1

Start Your TrialUtility Reporting Makes It Even Easier for Your Clients to Improve Their Credit

Utility payment reporting gives your clients the ability to build and improve credit by reporting monthly utility payments to major credit bureaus. Your clients’ on-time payments and up to 24 months of past payments appear as a credit tradeline to help increase your clients’ credit scores. Only on-time payments are reported.

WHAT WE DO FOR YOU

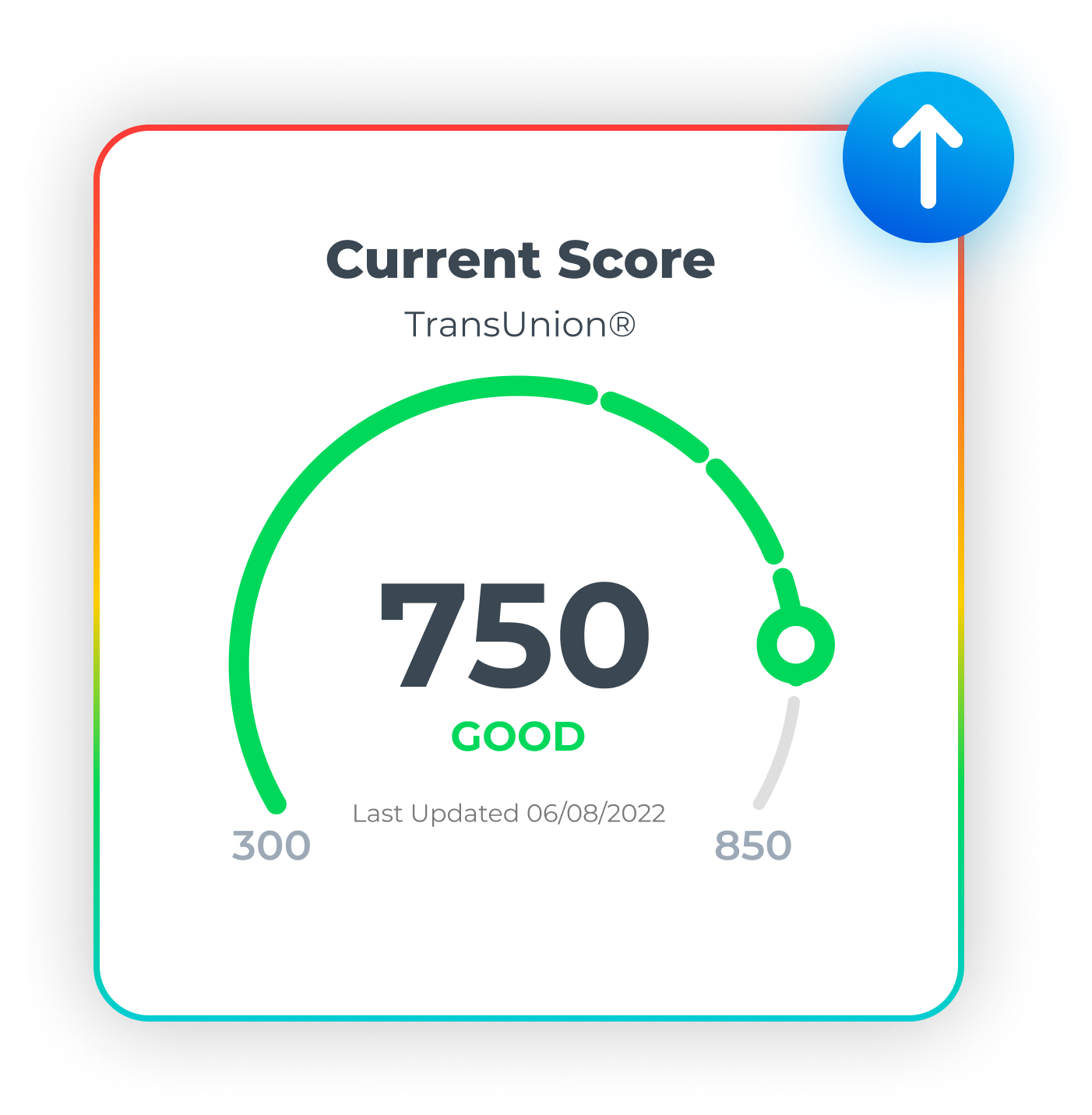

Raise your credit score

It’s easy to sign up. Start reporting your on-time utility payments in minutes.

1

Report up to 24 months of past payments to give your credit score a lift.

2

Reporting your on-time utility payments to the credit bureaus can help raise your credit score by demonstrating a history of on-time payments.

3

Get access to credit with a higher credit score. On-time utility reporting can lead to greater access to credit and financial opportunities, such as approvals for credit cards, loans and other lines of credit.

WHAT WE DO FOR YOU

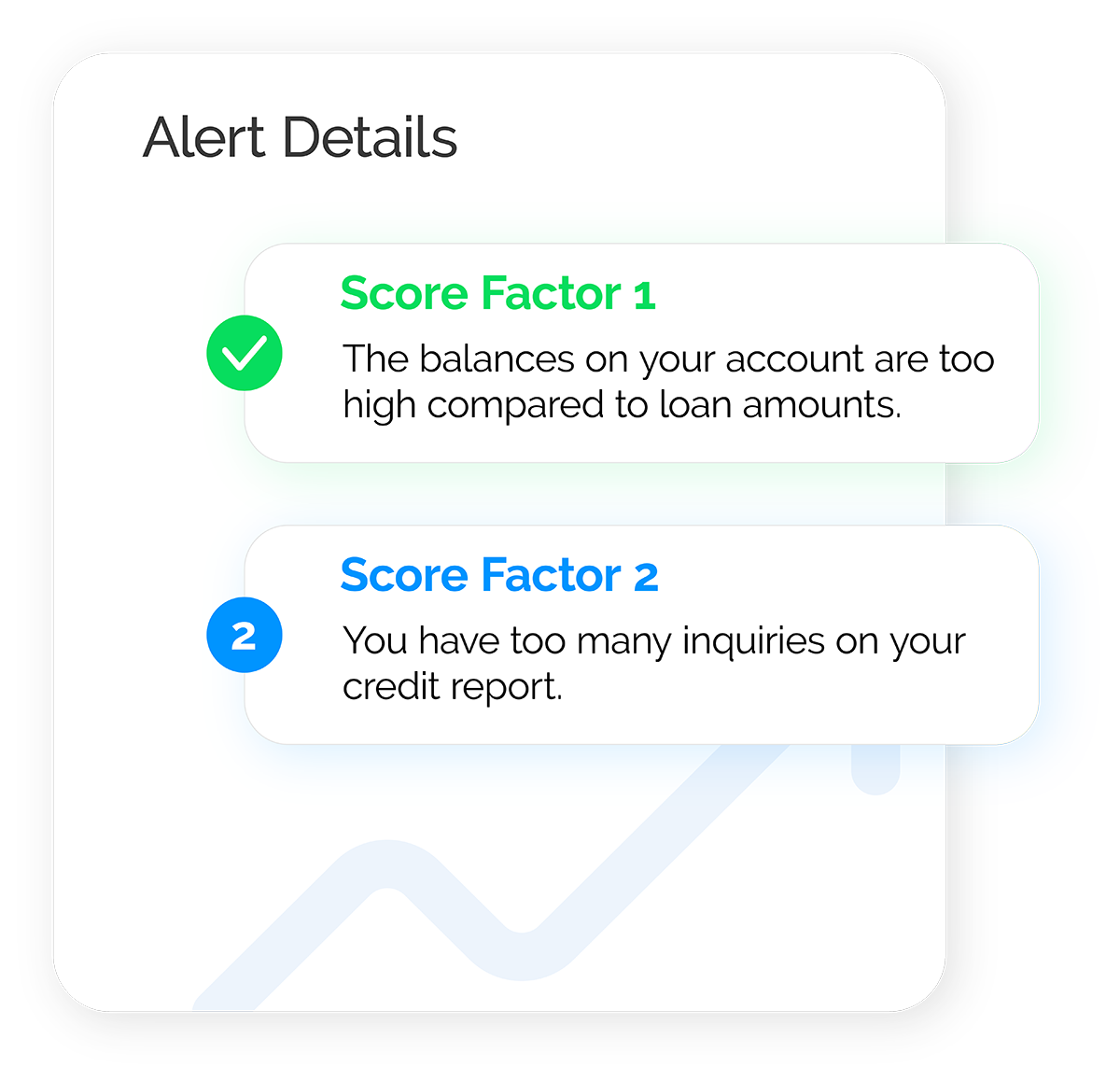

Rated Best for Credit Monitoring

We monitor your credit data from the major credit bureaus and provide real-time alerts for possible fraud. You can have peace of mind knowing you're protected.

Key Benefits

You’re already paying your utility bills – get credit for it!

We report only on-time utility payments to major credit bureaus. We report payments for a variety of utility types and work with most utility providers.

More